traineforranking.ru Market

Market

Instant Cash Checking Apps

Check Cashing Apps Alternative to Ingo · 1. Wells Fargo App · 2. US Bank App · 3. The Check Cashing Store · 4. Chase App · 5. Chime App · 6. AnytimeCheck · 7. Mobile check deposits are subject to verification and not available for immediate withdrawal. Other restrictions apply. In the Mobile Banking app menu, select. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. Get instant access to cash between $$5, (restrictions apply). Download the App Here. What Can You Do? Use your mobile phone to deposit checks from. With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes. QuickCheck lets you monitor your check cashing activity right from our mobile app, plus our web-portal lets you easily approve/decline checks that need further. Cash your checks online with the PayPal app and make bank trips a thing of the past. Find out more about online check depositing and get the app today. Tap Accounts. · Tap Balance. · Tap Cash a check. · Enter the check amount, take a picture of the front and back of your endorsed check with your mobile device, and. The top instant check cashing apps without verification include Ingo Money, Brink's Money, PayPal, Venmo, Cash App, Chime, and Flare Account. Check Cashing Apps Alternative to Ingo · 1. Wells Fargo App · 2. US Bank App · 3. The Check Cashing Store · 4. Chase App · 5. Chime App · 6. AnytimeCheck · 7. Mobile check deposits are subject to verification and not available for immediate withdrawal. Other restrictions apply. In the Mobile Banking app menu, select. With the GO2bank TM app, you can safely and easily cash checks right from your phone and get your money when you need it. Get instant access to cash between $$5, (restrictions apply). Download the App Here. What Can You Do? Use your mobile phone to deposit checks from. With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes. QuickCheck lets you monitor your check cashing activity right from our mobile app, plus our web-portal lets you easily approve/decline checks that need further. Cash your checks online with the PayPal app and make bank trips a thing of the past. Find out more about online check depositing and get the app today. Tap Accounts. · Tap Balance. · Tap Cash a check. · Enter the check amount, take a picture of the front and back of your endorsed check with your mobile device, and. The top instant check cashing apps without verification include Ingo Money, Brink's Money, PayPal, Venmo, Cash App, Chime, and Flare Account.

Easily add funds from a check to your spendwell account using Mobile Check Capture by Ingo Money 1 on the spendwell mobile app. Deposit checks to your Capital One bank accounts from pretty much anywhere. Why use mobile deposit? No trips to the bank. Feel the freedom of one less thing on. Simple as point, click, done. · Sign your check. · Open the app and select Deposit a check from the quick-action menu at the bottom of the Welcome screen, then. Mobile banking · MoneyLion · Varo · Chime · M1 Finance. Cash Checks and get your money instantly loaded onto any Debit Card. Financial Control at your Fingertips. Cash Checks and get your money instantly loaded onto any Debit Card. Financial Control at your Fingertips. Snap a picture of the front and back or your endorsed check. Deposit. Tap “Deposit” to deposit your money into the selected bank account. Depositing checks has. Use Mobile Check Capture by Ingo Money on the Serve mobile app to add funds from a check to your account. Follow these easy steps to cash a check! Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! Quick Guide to Check Cashing (pdf). Fees, Terms and Conditions: Branch Check Cashing Fee for Regions Checks: $25 or less (excluding Two-Party Business). Cash a check with our mobile app and, if approved, get your money in minutes. Just snap a few pictures with your phone and the money can be loaded to a debit. Mobile check cashing ease with no deposit holds. Cash business checks on your mobile device and get your money in minutes in your bank, prepaid card or. Zil is the ideal solution for anyone looking for a way for instant online check cashing. There's no need to visit a bank or an ATM with Zil; simply photograph. The Lodefast Check Cashing app allows you to cash checks and access your money anytime, anywhere, without waiting in lines or driving to a store or bank. With the PNC Mobile app you can securely deposit checks and access funds using your tablet or mobile phone & access your money faster with PNC Express. It's a snap Take photos of the front and back of your endorsed eligible check using our app. You'll get immediate confirmation that the deposit was received. Yes, you can cash a check online instantly without a bank account. There are a few financial apps that let you cash a check online—call them check-cashing apps. Easier, smarter banking starts with the Axos all-in-one mobile app. Get the App. For information on how to open a checking or savings account. —The Check Cashing Store/Money Mart charges 10 PERCENT which is $ So, no. And their app is currently undergoing a huge upgrade so it will be. Ingo Money: This app allows users to cash checks by simply taking a photo of the front and back of the check. The funds are then deposited into.

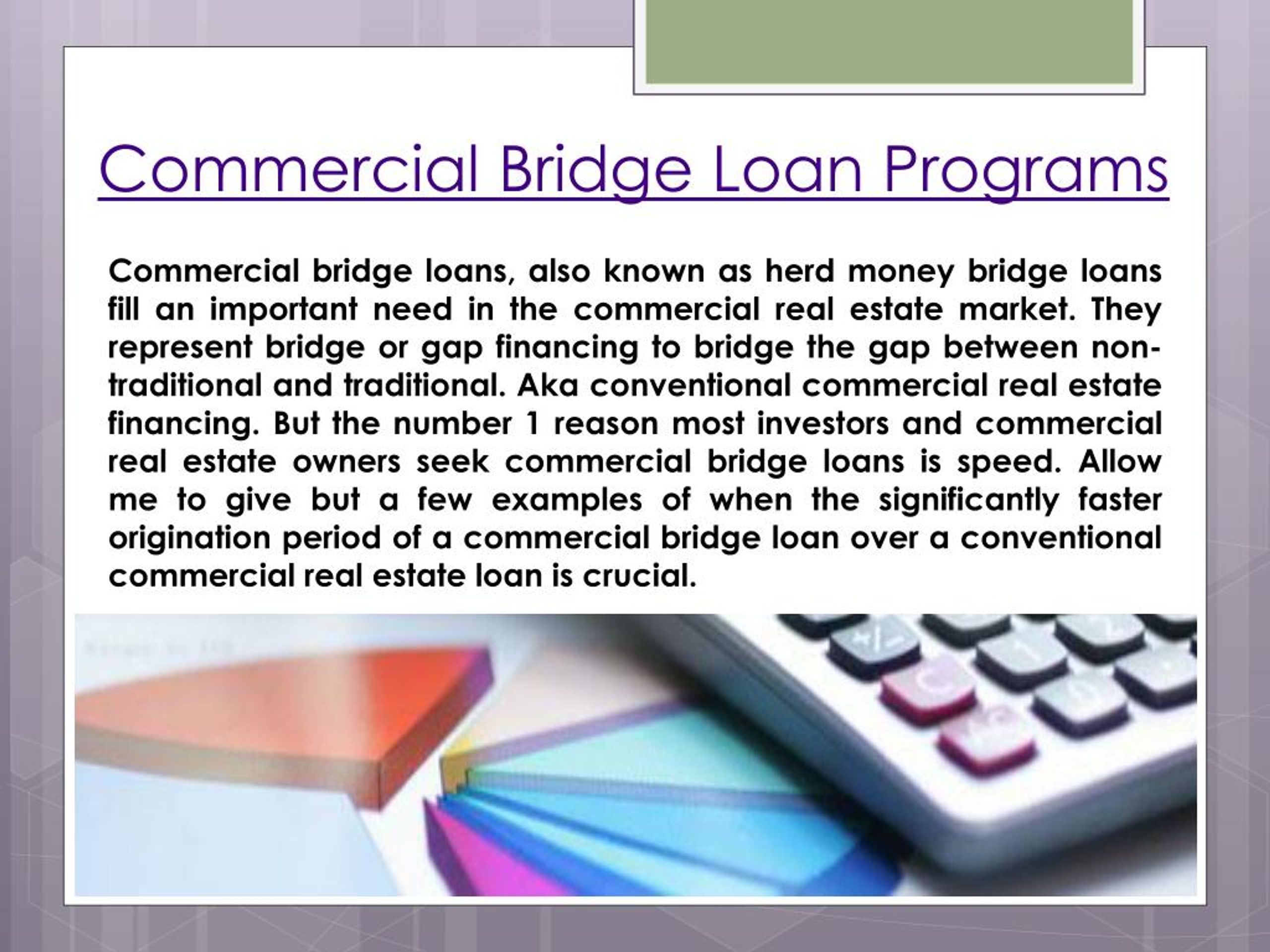

What Is A Commercial Bridge Loan

Commercial bridge loans are a short-term financing option that you can use temporary. Until you improve, refinance, lease up, sell, or complete the property. WHAT ARE COMMERCIAL BRIDGE LOANS? Commercial bridge loans are a type of short-term financing available to businesses needing capital. Bridge loans—also referred. Commercial bridge loans provide fast funding for properties that don't require rehab, or for properties where rehab is already complete, typically during a. So, fundamentally, commercial bridge loans are short-term commercial real estate financing vehicles that you have the option to use for temporary financing. Commercial bridge loans are a versatile financial tool for businesses and investors, providing solutions for various scenarios. Work with our team of production and credit experts to help finance your commercial bridge loans. Learn more. Bridge financing normally comes from an investment bank or venture capital firm in the form of a bridge loan or equity investment. Bridge financing is also used. Program Overview. Our commercial bridge loans are generally months with rates between – 13% with lender fees between 2 – 4%. We can fund nationwide. Commercial bridging loans are used for the purchase or development of a site/ property that will be used for commercial purposes. This would include, but is not. Commercial bridge loans are a short-term financing option that you can use temporary. Until you improve, refinance, lease up, sell, or complete the property. WHAT ARE COMMERCIAL BRIDGE LOANS? Commercial bridge loans are a type of short-term financing available to businesses needing capital. Bridge loans—also referred. Commercial bridge loans provide fast funding for properties that don't require rehab, or for properties where rehab is already complete, typically during a. So, fundamentally, commercial bridge loans are short-term commercial real estate financing vehicles that you have the option to use for temporary financing. Commercial bridge loans are a versatile financial tool for businesses and investors, providing solutions for various scenarios. Work with our team of production and credit experts to help finance your commercial bridge loans. Learn more. Bridge financing normally comes from an investment bank or venture capital firm in the form of a bridge loan or equity investment. Bridge financing is also used. Program Overview. Our commercial bridge loans are generally months with rates between – 13% with lender fees between 2 – 4%. We can fund nationwide. Commercial bridging loans are used for the purchase or development of a site/ property that will be used for commercial purposes. This would include, but is not.

At Capital Funding Financial, our commercial bridge loans close quickly in as little as days at rates starting at %! Our commercial bridge loans. Generally, the cash that you are allowed to borrow through a commercial bridge loan is around eighty percent of both properties' combined value (the properties. Bridge loans in commercial real estate are short-term commercial real estate loans that come at a high-interest rate. They are commonly used to quickly secure. Business owners, trusts, corporations and private partnerships often secure hard money loans for their commercial property needs. These private money loans. A bridge loan is short-term financing used until a person or company secures permanent financing. It provides immediate cash flow. Commercial bridging loans are used for the purchase or development of a site/ property that will be used for commercial purposes. This would include, but is not. Clopton Capital offers the most competitive commercial bridge loan options in the country. Our team of experts is committed to providing you with the best-fit. Bridge loans are asset-based, meaning they are fully collateralized, either with the property that is the subject of the loan, and/or other in combination with. Commercial bridge loans are a short-term financing option that you can use temporary. Until you improve, refinance, lease up, sell, or complete the property. Sunwest Bank delivers one of the top bridge loan programs for short-term financing to purchase, redevelop, or renovate commercial real estate assets. Our expert. What is a commercial bridging loan? Commercial bridging loans are short-term loans commonly used to buy property. With bridging finance, you can access cash. Commercial real estate bridge loans provide short-term financing that can bridge gaps between other payment or financing solutions. W Financial is a New York-based commercial real estate lender specializing in time-sensitive bridge loans ranging from $1 million to more than $50 million. iBorrow is a private commercial real estate lender that provides bridge loans on all commercial real estate property types $3M to $M+. Commercial Bridge Loans · A real estate investor has the opportunity to purchase a foreclosure property for a substantial discount. · A borrower is offered a. For this guide we're taking a close look at the finer details of bridging loans, to help you decide if this type of business finance is right for you. A commercial bridge loan provides financing to purchase a commercial property that's in need of significant renovations or upgrades. Bridge financing is designed to provide quick, interim capital to businesses or investors in commercial real estate. Bridge loans are short-term loans that allow the borrowers to buy sufficient time required in order to line up with the long-term funding, and thus helps in. Bridge loans are asset-based, meaning they are fully collateralized, either with the property that is the subject of the loan, and/or other in combination with.

What Is The Margin In Forex

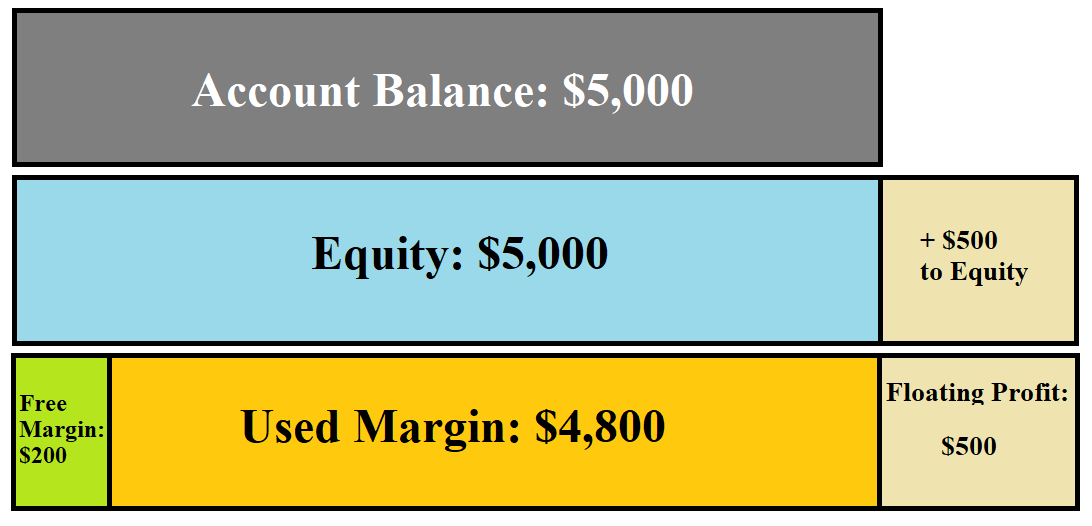

In forex, to control a $, position, your broker will set aside $1, from your account. Your leverage, which is expressed in ratios, is now You're. When you trade on margin, you can leverage the funds in your account to potentially generate large profits relative to the amount invested. The downside of. Margin is simply a portion of your funds that your forex broker sets aside from your account balance to keep your trade open and to ensure that you can cover. Your margin deposit is a percentage of the full position size, and the margin rate is determined by your trading provider. Markets with higher volatility or. Margin, in the context of forex trading, is a collateral that traders need to deposit with their brokers to open and maintain trading positions. It allows you. Margin trading is a tool used by traders to access leverage, which allows you to access more capital for investment or trading purposes than you may have at. Margin call is when the equity on your account—the total capital you have deposited plus or minus any profits or losses—drops below your margin requirement. You. Explore the world of forex margin trading with traineforranking.ru Access the right leverage, margin requirements, and currency pairs for you. Forex margin trading is when foreign exchange traders borrow money from their brokers in order to make bigger forex trades. Read on. In forex, to control a $, position, your broker will set aside $1, from your account. Your leverage, which is expressed in ratios, is now You're. When you trade on margin, you can leverage the funds in your account to potentially generate large profits relative to the amount invested. The downside of. Margin is simply a portion of your funds that your forex broker sets aside from your account balance to keep your trade open and to ensure that you can cover. Your margin deposit is a percentage of the full position size, and the margin rate is determined by your trading provider. Markets with higher volatility or. Margin, in the context of forex trading, is a collateral that traders need to deposit with their brokers to open and maintain trading positions. It allows you. Margin trading is a tool used by traders to access leverage, which allows you to access more capital for investment or trading purposes than you may have at. Margin call is when the equity on your account—the total capital you have deposited plus or minus any profits or losses—drops below your margin requirement. You. Explore the world of forex margin trading with traineforranking.ru Access the right leverage, margin requirements, and currency pairs for you. Forex margin trading is when foreign exchange traders borrow money from their brokers in order to make bigger forex trades. Read on.

In futures, the exchange dictates initial margins of varying amounts depending on the volatility of the currency. In retail spot Forex, brokers do not. First, leverage and margin are two different things. Leverage refers to how much you have invested in a transaction, while margin refers to the amount of. Understanding Forex Margin Margin trading involves using borrowed funds from a broker to trade a currency pair. The margin is essentially a security deposit. Futures margins are set by the exchange where the product trades. All brokers must ensure their customers have sufficient funds to meet margin. Leverage is the ability to control a large position with a small amount of capital. It is usually denoted by a ratio. For example, if your account has a. All Forex brokers require a minimum margin level, which will vary between brokers. When your margin level reaches %, it means that you can't take any new. Example 2: A leverage ratio means a margin requirement of 1/= = 1% margin requirement. Let's assume that you have a balance of 5, USD in your. Forex margin is a 'good faith' deposit that you put up as collateral to initiate a trade. Essentially, it's the minimum amount that you need in your account to. You can trade Forex and CFDs on leverage. This can allow you to take advantage of even the smallest moves in the market. When you trade with FXCM. All assets in each currency are combined to determine a single net asset value in that currency. Separate margin requirement calculations are used when. To do this, traineforranking.ru increases the size of the margin requirement at specific quantity levels, known as step margin levels. You can view a market's step margin. What Is Margin Level? Put simply, Margin Level indicates how “healthy” your trading account is. It is the ratio of your Equity to the Used Margin of your open. What is a margin call in Forex? When you're trading forex with leverage, this means the broker gives you additional margin to trade with, according to the. It is the percentage of your own money used in a leveraged trade. Here is an example to illustrate the margin level meaning in forex. If you use 10x leverage. Margin level is the total sum of margin 'deposits' that you are required to make at any one moment in time. Best way to explain what is margin level in Forex is to picture it as collateral set aside from your account to serve as a good faith deposit - a guarantee of. In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. So. How Margin Works in Forex Trading “Margin is a central concept when it comes to trading with leverage. In fact, it is what makes it possible to trade with. In trading parlance, the margin refers to the monetary deposit that a trader makes to enter a position and maintain it. If you trade on a margin, you stand to. 'Margin' (or used margin) represents the amount of funds required to secure positions. When you place a trade, the 'margin' is locked in until the trade is.

Life Insurance After Death

the beneficiary – the person or persons named by the policy owner – will receive policy proceeds (benefit) upon the death of the insured person. Having young. In most cases, your beneficiaries can claim a life insurance payout on a policy that's active, also known as "in force," but there's a specific process they'll. Life insurance benefits are typically paid when the insured party dies. Beneficiaries file a death claim with the insurance company along with a certified copy. When the cause of death is suicide, most life insurers will approve a claim only if the policy has been fully active for two years. Any lapses in the policy. Most life insurance plans include a death benefit that is paid to your nominee/beneficiary after your death. That amount can be used to repay outstanding loans. What If Someone Dies Soon After Getting Life Insurance? In short, the beneficiaries' claims are more likely to be denied. A life insurance company is. If you die during the policy's term, your heirs receive the death benefit payout. If you outlive the term, your coverage (and the payout) expires. Term policies. Life Insurance Basics Life insurance can help secure your family's financial future after an unexpected death. Life insurance policies have one thing in. All life insurance plans include a death benefit, which is the payout your beneficiaries receive at your death if your policy is still in force. Learn more. the beneficiary – the person or persons named by the policy owner – will receive policy proceeds (benefit) upon the death of the insured person. Having young. In most cases, your beneficiaries can claim a life insurance payout on a policy that's active, also known as "in force," but there's a specific process they'll. Life insurance benefits are typically paid when the insured party dies. Beneficiaries file a death claim with the insurance company along with a certified copy. When the cause of death is suicide, most life insurers will approve a claim only if the policy has been fully active for two years. Any lapses in the policy. Most life insurance plans include a death benefit that is paid to your nominee/beneficiary after your death. That amount can be used to repay outstanding loans. What If Someone Dies Soon After Getting Life Insurance? In short, the beneficiaries' claims are more likely to be denied. A life insurance company is. If you die during the policy's term, your heirs receive the death benefit payout. If you outlive the term, your coverage (and the payout) expires. Term policies. Life Insurance Basics Life insurance can help secure your family's financial future after an unexpected death. Life insurance policies have one thing in. All life insurance plans include a death benefit, which is the payout your beneficiaries receive at your death if your policy is still in force. Learn more.

Your life insurance company will make payments after your death to the person you name in your policy. This person is called your beneficiary. You can name. All you have to do is simply go to their website and submit a request. You'll need the deceased's death certificate, social security number, full name, date of. A life insurance death benefit can provide much-needed financial support after the death of a loved one. As a beneficiary, you can use the money to cover. How to Find Out if a Life Insurance Policy Exists After Death · Talk to Friends, Family Members, and Acquaintances · Search Personal Belongings · Check Old Bills &. Life insurance provides money to your family after you die to help them pay for burial costs, living expenses, bills, and education. This guide takes out the guesswork with a step-by-step explanation of how to claim life insurance after death, along with answers to the most common questions. Life insurance is typically not considered part of an estate after death. Learn about how life insurance works and what happens to it when someone passes. a copy of the death certificate (or a photocopy) AND · a DD Form , Certificate of Release or Discharge from Active Duty OR · NGB, Report of Separation and. These pages will walk you through the process of reporting the death of someone covered by the Federal Employees' Group Life Insurance Program. What are the different types of death benefits? · Accidental death benefit: This only pays out if the insured dies due to a qualifying accident listed in the. The National Association of Insurance Commissioners (NAIC) offers a free, secure, national service that allows you to search for a deceased person's lost life. The National Association of Insurance Commissioners (NAIC) wants to help consumers be prepared. When it comes to receiving a death benefit after a family. Find the policy or contact the insurer. Find the insured's life insurance policy, which will have the insurance company's contact information and claim. How to Claim Life Insurance After Death To claim life insurance benefits, the beneficiary should contact the insurance company's local agent or check the. What to do if your life insurance claim is denied · Contact the insurer: Reach out to the life insurance company directly. · Involve the state insurance. To begin the claims process, submit a certified copy of the death certificate from the funeral director with the policy claim. Life insurance provides financial support to surviving dependents or other beneficiaries after the death of an insured policyholder. Here are some examples of. In order to process a death claim, most companies require a properly completed claim form, a certified copy of the insured's death certificate and the policy. If you're making a life insurance claim, you should contact Legal & General as soon as possible after the death of the insured person. As explained below.

Using 401 K To Buy A House

Generally, you can use funds from your (k) to buy a house. Whether it is a good idea depends on your financial situation as there are drawbacks. A (k) is. Using (k) as a first-time home buyer might be better than other loans regarding interests and total amounts. Still, the penalties and rules associated with. You can withdraw money from a (k) retirement fund for any purpose including purchasing an apartment or home, but it will cost you to do this. Using your k to buy a house is generally not recommended, as there are significant penalties and taxes associated with withdrawing funds from your k. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. However, it's generally not recommended to use your (k) funds to buy a house, even if the situation appears ideal. Whether you're borrowing from your plan or. Using a k Loan to Purchase a House To avoid paying for mortgage insurance, you must make a downpayment of at least 20% of the purchase price of your home. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement. You can borrow up to $50, or half of the value of the account, whichever is less, as long as you are using the money for a home purchase.4 This is better. Generally, you can use funds from your (k) to buy a house. Whether it is a good idea depends on your financial situation as there are drawbacks. A (k) is. Using (k) as a first-time home buyer might be better than other loans regarding interests and total amounts. Still, the penalties and rules associated with. You can withdraw money from a (k) retirement fund for any purpose including purchasing an apartment or home, but it will cost you to do this. Using your k to buy a house is generally not recommended, as there are significant penalties and taxes associated with withdrawing funds from your k. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. However, it's generally not recommended to use your (k) funds to buy a house, even if the situation appears ideal. Whether you're borrowing from your plan or. Using a k Loan to Purchase a House To avoid paying for mortgage insurance, you must make a downpayment of at least 20% of the purchase price of your home. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement. You can borrow up to $50, or half of the value of the account, whichever is less, as long as you are using the money for a home purchase.4 This is better.

However, it's generally not recommended to use your (k) funds to buy a house, even if the situation appears ideal. Whether you're borrowing from your plan or. In conclusion, while investing in a house using your k account may be an option for some people, it is generally not recommended due to the fees, penalties. Can I Use My to Buy a House? Yes, you can use your k to buy a house. But should you? This is your guide to understanding how it works and deciding if. Just using solo k funds to invest in real estate is the most common method. Under the all cash method, the solo k ends up owning the property free and. You can take a withdrawal from your k without incurring the early withdrawal penalty if it's for a primary residence and you can show you don. Can you use a (k) to buy a house? Yes, it's possible to take money out of your (k) to purchase a house outright or cover the down payment on a house. Bottom line, using those retirement funds to purchase a home can be a great option. Contact your (K) administrator to learn more about the loan and. Using (k) funds to purchase a home: The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the. You can also choose to buy a home in a place where you'd like to live post-retirement. If the price of the property you wish to buy is more than the money you. You can use your (k) for a down payment by withdrawing funds or taking out a loan. Each option has its own pros and cons — the best for you will depend. You can choose to borrow against it will be tax free if paid back within 15 years if you are using to purchase a primary residence. Since it is. Buying a home can be a huge financial undertaking, often requiring years of planning and saving, using a (k) retirement plan to buy a home is possible. For instance, when purchasing a property with a k, any income generated from that property will not be taxed. Instead, the income is put directly into the. In addition to that, you may pay income tax on whatever amount you withdraw. Let's look at each of these options individually. Option 1: (k) funds. When. The biggest downside to using money from your (k) for a home purchase is that it significantly diminishes your retirement savings. Even if you pay back the. However, using a (k) for a first-time home purchase is usually not advisable. Both qualified loans and withdrawals have some potential drawbacks — primarily. If you're looking to buy a house, it's important to go into the process And, keep in mind, generally a (k) loan does not count in your debt-to. You can borrow or withdraw money from your (k) to buy a house. But most experts say it isn't a great idea. We'll explore the ins and outs of using retirement. In conclusion, while investing in a house using your k account may be an option for some people, it is generally not recommended due to the fees, penalties. “It's possible to use funds from your (k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you've.

What Is The Pareto Principle

:max_bytes(150000):strip_icc()/TermDefinitions_Paretoprinciple-42d314180f794822b1b799724c2fc70d.jpg)

At its core, the Pareto Principle is about uneven distribution. Applied to economics, it states that the relationship between causes and effects – or inputs and. The Pareto Principle. The Pareto principle (also known as the 80/20 rule, the law of the vital few, or the principle of factor sparsity) states that, for many. The Pareto principle, also known as the 80/20 rule, is a theory maintaining that 80 percent of the output from a given situation or system is determined by Learn more about the Pareto Principle, or 80/20 Rule, which refers to a theory that 80% of the consequences come from 20% of the effort. This rule suggests that 80% of effects come from 20% of causes. For example, 80% of a company's revenue may come from 20% of its customers, or 80% of a person's. Applying the Pareto's principle to marketing · 80% of profits come from 20% of customers · 80% of product sales from 20% of products · 80% of sales from 20% of. The Pareto principle states that 80% of the problems are the result of 20% of the causes. To this end, a relatively simple chart is used to highlight problems. The Pareto principle, also known as the 80/20 rule, is a theory maintaining that 80% of your success comes from 20% of your effort. 80/20 Rule (Pareto Principle). Noun. This principle, named after economist Vilfredo Pareto, states that roughly 80% of effects come from 20% of causes. In the. At its core, the Pareto Principle is about uneven distribution. Applied to economics, it states that the relationship between causes and effects – or inputs and. The Pareto Principle. The Pareto principle (also known as the 80/20 rule, the law of the vital few, or the principle of factor sparsity) states that, for many. The Pareto principle, also known as the 80/20 rule, is a theory maintaining that 80 percent of the output from a given situation or system is determined by Learn more about the Pareto Principle, or 80/20 Rule, which refers to a theory that 80% of the consequences come from 20% of the effort. This rule suggests that 80% of effects come from 20% of causes. For example, 80% of a company's revenue may come from 20% of its customers, or 80% of a person's. Applying the Pareto's principle to marketing · 80% of profits come from 20% of customers · 80% of product sales from 20% of products · 80% of sales from 20% of. The Pareto principle states that 80% of the problems are the result of 20% of the causes. To this end, a relatively simple chart is used to highlight problems. The Pareto principle, also known as the 80/20 rule, is a theory maintaining that 80% of your success comes from 20% of your effort. 80/20 Rule (Pareto Principle). Noun. This principle, named after economist Vilfredo Pareto, states that roughly 80% of effects come from 20% of causes. In the.

The 80/20 rule implies that 80% of the benefit comes from 20% of the causes. Similarly, 20% of a business causes 80% of the delay, defects and lost profits. The 80/20 Rule Explained (Guide to the Pareto Principle) · The 80/20 rule, also called the Pareto principle, is a statistical rule that states that 80% of. the Pareto principle meaning: the idea that a small quantity of work or resources (= time, money, employees, etc.) can produce a. Learn more. The simplest way to describe the Pareto Principle is the 80/20 rule: 80% of the results come from 20% of the causes. Say "No" and focus on the important. The Pareto Principle is the observation (not law) that most things in life are not distributed evenly. It can mean all of the following things. Otherwise known as the 80/20 rule, the Pareto rule is a tool that can be used to improve project management efficiency. The rule states that 80% of the results. The Pareto Principle What is the Pareto Principle? The Pareto Principle is an economic ideology that was developed by Joseph Juran, after reading the. Pareto's Rule Theory · Pareto Rule, · "80 percent of output is produced by 20 percent of input" · "20 percent of clothes in a wardrobe are worn 80 percent. The 80/20 Principle states that 80% of the output or results will come from 20% of the input or action. The pareto principle. The Pareto Principle was propounded by Vilfredo Pareto () when he observed that 20 percent of the people of Italy owned 80 percent of the wealth. The 80/20 inventory rule states that 80% of your profits should come from 20% of your inventory. The rule is based on the Pareto Principle, a management. 80/20 Rule – The Pareto Principle. The 80/20 Rule (also known as the Pareto principle or the law of the vital few & trivial many) states that, for many events. The Pareto principle states that, for many events, roughly 80% of the effects come from 20% of the causes. Applying the Pareto's principle to marketing · 80% of profits come from 20% of customers · 80% of product sales from 20% of products · 80% of sales from 20% of. The Pareto principle is a helpful rule of thumb when trying to optimize the allocation of resources. The correct distribution of resources can make a. What is the Pareto principle? The Pareto principle states that roughly 80% of the consequences come from 20% of the causes. In other words, a small minority of. Pareto Principle The Pareto Principle, also known as the rule, refers to the concept that 80% of the effects come from 20% of the causes. It is widely. The Pareto Principle refers to the '80/20 rule' which describes that 20 percent of causes are often responsible for 80 percent of effects or outcomes. The rule is the principle that 20% of what you do results in 80% of your outcomes. Put another way, 80% of your outcomes result from just 20% of your. What's the secret to getting more done with less effort? The lesson we should learn from the Pareto principle is that some inputs are vital, while others are.

Costing Of Corrugated Box

One of the best ways to minimize the cost of corrugated boxes is to integrate the plans for packaging in the product planning phase. You can check how. Corrugated · 14 x 10 x 6" Corrugated Boxes (Bundle of 25) · 6 x 4 x 2" White Corrugated Mailers (Bundle of 50) · 12 x 12 x 6" Flat Corrugated Boxes (Bundle of. This document provides information and formulas for calculating the cost of corrugated boxes. Key details include: Box dimensions, paper thickness in GSM. Stock Size Boxes ; Corrugated Boxes, 4 x 4 x 4", White · 4 x 4 x 4" - White. 25 / Bundle / Bale. $ /EA. Add ; Corrugated Boxes, 4 x 4 x 5", Kraft. 4 x 4. Prices in the Corrugated Boxes market range from $ to $X,traineforranking.ru, depending on Strength of Corrugated Material, Quantity of Boxes and Box Features. Hundreds of Box Sizes Available! ; BOX, 16" x 10" x 10", ECT32, $, $ A good price for a box should be under $1 for a folding carton, and under $ for a fully printed labeled corrugated box, and $ for a rigid set-up box. If. A good rule of thumb in corrugated boxes is "Deeper is Cheaper". If you can configure your box so that it opens on the smallest dimensions and the largest. 3 Ply Corrugated Box · 3 Ply Corrugated Box. ₹ 12 / Piece ; Single Wall 3 Ply Slipper Packaging Box · Single Wall 3 Ply Slipper Packaging Box. ₹ 3 / Box ; 3Kg. One of the best ways to minimize the cost of corrugated boxes is to integrate the plans for packaging in the product planning phase. You can check how. Corrugated · 14 x 10 x 6" Corrugated Boxes (Bundle of 25) · 6 x 4 x 2" White Corrugated Mailers (Bundle of 50) · 12 x 12 x 6" Flat Corrugated Boxes (Bundle of. This document provides information and formulas for calculating the cost of corrugated boxes. Key details include: Box dimensions, paper thickness in GSM. Stock Size Boxes ; Corrugated Boxes, 4 x 4 x 4", White · 4 x 4 x 4" - White. 25 / Bundle / Bale. $ /EA. Add ; Corrugated Boxes, 4 x 4 x 5", Kraft. 4 x 4. Prices in the Corrugated Boxes market range from $ to $X,traineforranking.ru, depending on Strength of Corrugated Material, Quantity of Boxes and Box Features. Hundreds of Box Sizes Available! ; BOX, 16" x 10" x 10", ECT32, $, $ A good price for a box should be under $1 for a folding carton, and under $ for a fully printed labeled corrugated box, and $ for a rigid set-up box. If. A good rule of thumb in corrugated boxes is "Deeper is Cheaper". If you can configure your box so that it opens on the smallest dimensions and the largest. 3 Ply Corrugated Box · 3 Ply Corrugated Box. ₹ 12 / Piece ; Single Wall 3 Ply Slipper Packaging Box · Single Wall 3 Ply Slipper Packaging Box. ₹ 3 / Box ; 3Kg.

Corrugated boxes offer a unique combination of affordability and performance, making them an ideal choice for businesses prioritizing value. Printer Box - x x 6. 18x12x8 Corrugated Box. MSRP: $ Your Cost. For price corrugated box calculation purchases, search with ease at traineforranking.ru and find exactly what you need using the categories and search filters. You can. Kraft or RSC Boxes, RSC means regular slotted cartons, are the cornerstone of corrugated shipping boxes used in cost effective packaging and shipping. In the American domestic market, the Corrugated Box prices declined from about USD/MT (CIF, for less than gsm) in January'23 to about USD/MT in June. 25 - 4"x4"x4" CORRUGATED BOX CARTON SHIPS NOW! 25 HEAVY DUTY 4" X CORRUGATED BOXES PERFECT FOR SHIPPING A VARIETY OF ITEMS AT THE LOWEST POSSIBLE COST! Stock Size Boxes ; Corrugated Boxes, 4 x 4 x 4", White · 4 x 4 x 4" - White. 25 / Bundle / Bale. $ /EA. Add ; Corrugated Boxes, 4 x 4 x 5", Kraft. 4 x 4. Producer Price Index by Industry: Corrugated and Solid Fiber Box Manufacturing: Corrugated Shipping Containers for Paper and Allied Products. Carton consumption or ply board consumption formula: (Length + Width + Allowance) x (Width + Height + Allowance) x 2 / A pandemic-driven rise in e-commerce has put substantial upward price pressure on corrugated boxes (a $B market), and additional price surges are expected. Unit Conversion: Based on the order structure of the carton factory, the average area of each carton can be calculated, Then the number of. Give your products an elegant appeal with sublime corrugated carton box price from traineforranking.ru These corrugated carton box price are offered at. A good rule of thumb in corrugated boxes is "Deeper is Cheaper". If you can configure your box so that it opens on the smallest dimensions and the largest. Buy packaging materials online. High-quality corrugated carton boxes, security bags and courier packaging bags at best prices. Fastest shipping in Delhi/NCR. Kraft or RSC Boxes, RSC means regular slotted cartons, are the cornerstone of corrugated shipping boxes used in cost effective packaging and shipping. The formula used for this calculation is to measure the exterior of the box used, multiply the length times the width times the height, and then divide the. Have you thought about what the inefficiencies and ergonomic issues in your packaging line are costing you? The total cost goes beyond that of the box. Standard Corrugated Boxes ; Color · White () ; Length · 25 (5) ; Width · 25 (3) ; Height · 24 (25) ; Thickness · C Flute ") (). The latest report titled “Corrugated Box Production Cost Report” by Procurement Resource, a global procurement research and consulting firm. CORRUGATED CARDBOARD BOXES ; Item(s). Standard RSC Corrugated Boxes. as low as $ / each ; 87 Item(s). 32 ECT Corrugated Boxes. as low as $ / each ;

Creating A Trust Vs A Will

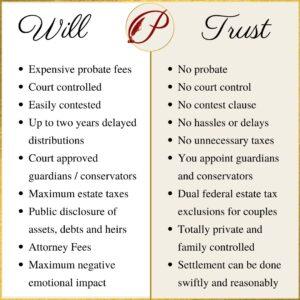

A will is a relatively simple document that outlines how you want your assets to be taken care of after you die. · A living trust is a more complex legal. The difference between wills and trusts Wills provide instructions on how to distribute your assets after you die. Trusts are legal contracts that allow you. A trust is a relationship created at the direction of an individual, in which one or more persons or institutions hold the individual's property. Read more. The beneficiaries you name in your living trust receive the trust property when you die. You could instead use a will, but wills must go through probate—the. Cost: Finally, a revocable living trust can be more expensive to set up than a will. However, the cost may be worth it for those who want to avoid probate. Why establish a trust? · Providing for family members if something should happen to you · Dictating the distribution of your assets to specific beneficiaries. While a will names who things would go to, a trust takes it one step further. “We are going ahead and transferring that property into our trust, the care of our. A Trust can be set up during a person's lifetime or on their death, whereas, a Will won't be activated until the person dies. A Will is a document that outlines. What makes a trust different from a will, however, is that the trust can continue to operate even after you're gone. This distinction can be especially helpful. A will is a relatively simple document that outlines how you want your assets to be taken care of after you die. · A living trust is a more complex legal. The difference between wills and trusts Wills provide instructions on how to distribute your assets after you die. Trusts are legal contracts that allow you. A trust is a relationship created at the direction of an individual, in which one or more persons or institutions hold the individual's property. Read more. The beneficiaries you name in your living trust receive the trust property when you die. You could instead use a will, but wills must go through probate—the. Cost: Finally, a revocable living trust can be more expensive to set up than a will. However, the cost may be worth it for those who want to avoid probate. Why establish a trust? · Providing for family members if something should happen to you · Dictating the distribution of your assets to specific beneficiaries. While a will names who things would go to, a trust takes it one step further. “We are going ahead and transferring that property into our trust, the care of our. A Trust can be set up during a person's lifetime or on their death, whereas, a Will won't be activated until the person dies. A Will is a document that outlines. What makes a trust different from a will, however, is that the trust can continue to operate even after you're gone. This distinction can be especially helpful.

Probate is public, so leaving property through a will means that the details of your estate will become part of the public record. On the other hand, trusts are. A trust may be created to manage a person's property or protect it from creditors. Some trusts provide tax benefits or reduce tax liabilities. To create a trust. Assets held in trust will also avoid probate. (back to top). How Does a Revocable Trust Avoid Probate? Designate a trustee. The trustee you choose will manage your trust in the event of your incapacitation or death. · Designate your beneficiaries. Beneficiaries. The main difference is that a trust lets you transfer assets to beneficiaries when you're still alive. A will transfers your assets when you die. A trust is a. However, there's one key difference,” says Ruhe. “By creating and transferring your assets to a revocable trust, you can avoid the probate process that's. Trusts will be a lot more expensive. Depending on where you are and the type of trust planning being done, expect it to cost anywhere from $ Will: Wills offer the testator a direct say on the distribution of their assets, but do not provide extended control over how the beneficiary uses them. Trust. A revocable living trust agreement or declaration is usually longer and more complicated than a will, and transfer of assets to the trustee can be time-. “Living will” vs “Living trust”: Are they the same thing? No. A living trust is for financial affairs. A living. Wills don't go into effect until you pass away, whereas a living trust is effective immediately upon signing and funding it. Alternatively, in some cases a. Living Trust vs Will While both living trusts and wills are essential components of estate planning, they serve different purposes. Living trusts are active. Trust is about managing and controlling your money during your lifetime or after you're gone while a will is about the distribution of your assets after you. A testamentary trust is one that you create as part of your will, so it starts operating only after your death. It, too, tells the trustee how to use the trust. If the will creates one or more trusts upon your death, the will is often called a testamentary trust will. If you create a trust, you are described as the. A will is a document that lists where assets should be designated in the event of death and under what conditions. A trust is a vehicle to store. A trust never has an executor. It has a trustee. A living trust is established by the settlor to protect their property while they're alive;. False The costs of creating and administering living trusts outweigh the A revocable living trust saves no more estate taxes than a properly drafted will with. In estate planning, a living trust is a legal entity that owns your assets during your lifetime. When you create a living trust in Ontario, you transfer. If someone dies with a will instead of a RLT a court probate proceeding is often required. By contrast, a RLT agreement creates a legal trust entity upon.

New Mineable Coins

I kept mining during the bear market. Sitting on over $43k in Kaspa that I GPU mined, and over $k in SpaceMesh which required GPUs to plot. Whereas Bitcoin releases new coins into circulation through mining, some cryptocurrencies, such as Ripple, Cardano, and Stellar, are “pre-mined”. Mineable coins using the proof of work (PoW) consensus algorithm to generate new blocks on the blockchain. $T Sector Market Cap. Total Assets. Mining-based altcoins are cryptocurrencies that utilize a mining process to validate and add transactions to their respective blockchains. Mining can be done. Best Crypto to Mine in · Bitcoin – Overall best coin to mine in · Monero – Best coin to mine with GPU in · Zcash – Best privacy coin to mine in Most people think of crypto mining simply as a way of creating new coins. Crypto mining, however, also involves validating cryptocurrency transactions on a. List of mineable coins by market cap, including algorithm, supply and more. Latest coins and tokens added to ADVFN that are not currently listed on the exchanges that we support. Crypto mining information for Bitcoin, Etheruem, Litecoin, Monero, Zcash, and + more. Select a cryptocurrency for more information about mining. I kept mining during the bear market. Sitting on over $43k in Kaspa that I GPU mined, and over $k in SpaceMesh which required GPUs to plot. Whereas Bitcoin releases new coins into circulation through mining, some cryptocurrencies, such as Ripple, Cardano, and Stellar, are “pre-mined”. Mineable coins using the proof of work (PoW) consensus algorithm to generate new blocks on the blockchain. $T Sector Market Cap. Total Assets. Mining-based altcoins are cryptocurrencies that utilize a mining process to validate and add transactions to their respective blockchains. Mining can be done. Best Crypto to Mine in · Bitcoin – Overall best coin to mine in · Monero – Best coin to mine with GPU in · Zcash – Best privacy coin to mine in Most people think of crypto mining simply as a way of creating new coins. Crypto mining, however, also involves validating cryptocurrency transactions on a. List of mineable coins by market cap, including algorithm, supply and more. Latest coins and tokens added to ADVFN that are not currently listed on the exchanges that we support. Crypto mining information for Bitcoin, Etheruem, Litecoin, Monero, Zcash, and + more. Select a cryptocurrency for more information about mining.

The CPU Coin List is a sortable list of Alternate Cryptocurrencies (Altcoins) that can be mined on your CPU. The coins with GPU miners have the GPU. coin offerings, and shut down mining. Many Chinese miners have since This event would eventually open more opportunities for new capital and new people in. Top 5 free crypto mining apps in · 1. HOT (Here Wallet) · 2. Harvest Moon · 3. NiceHash QuickMiner · 4. PI Network · 5. Unmineable. This guide will provide an introduction to mining new altcoins – a potential avenue for those who missed out on the rise of Bitcoin. Results from mining calculator are estimation based on the current difficulty, block reward, and exchange rate for particular coin. The most popular ones include Bitcoin, Ethereum, Tether, Cardano, and more. There are different categories of crypto including mining-based coins, stablecoins. See our list of new cryptocurrencies added and tracked recently. We list brand new mineable coins, ERC tokens, DeFi tokens and more. What if we told you that you could mine cryptocurrency using your smartphone? In this article, we will talk about mining via your phone, which coins you can. BTcoin is a new digital currency. This app allows you to access and grow your BTcoin holdings and serves as wallet to host your digital assets. The Best Crypto to Mine in · 1. Bitcoin (BTC). Current Mining Reward: BTC/block · 2. Monero (XMR). Current Mining Reward: XMR/block · 3. Litecoin . CoinGecko is another data aggregator that lists new coins with much of the same information that CoinMarketCap offers. Crypto data aggregators may report late. New. ASIC. GPU > 3GB. GPU > 4GB. GPU > 6GB. CPU. Kaspa & forks Be sure to set the user field with the coin you are mining, your address and your worker name. Newest Proof- of-work coins · 1 Ore ORE. $ 5mo · 2 BLOCX BLOCX. $ 1yr · 3 Archethic UCO. $ 2yr · 4 Kaspa KAS. $ 2yr · 5 EthereumPoW. Bitcoin miners and mining are required for new bitcoins to enter into circulation new coins is slowly dwindling. Sometime around , there will be no more. The minable coins are created by (and are rewarded to) the miner, for successfully verifying transactions on the network and adding it to the newly created. Mining, Minting, Mirrored Assets, ML, Mobile, Mobility, Mortgage, Movie, Multi Privacy Coins, Rating, R&D, Real Estate, Real world assets, Rebase Tokens. Coins that generate new blocks through proof of stake (PoS), which means the Mining · NFTs · Op-Eds · Ordinals · Partnerships · People · Politics · Privacy. The Mineable Coin Announcement forum is for discussing new mineable coins and cryptocurrency technologies. One topic per coin, please. Feel free to submit a. new block is added. Miners are rewarded for their efforts with new coins. What is crypto mining? Bitcoin mining or crypto mining is what makes the.

How Much Will I End Up Paying On My Mortgage

Use this calculator to input the details of your mortgage and see how those payments break down over your loan term. Find out how much your monthly mortgage payment could be, based on your home's purchase price and the terms of your loan. Calculate the true cost of homeownership and the impact of monthly allocations with the Total Mortgage Costs Calculator from E-Central Credit Union in CA. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. How Do I Lower My Monthly Mortgage Payment? · Don't pay for PMI: A down payment of at least 20% will mean not having to pay for private mortgage insurance each. Simple. Multiply the monthly payment by That's the total of your payments (if that's the question). Subtract the original loan principal. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. By paying extra $ per month starting now, the loan will be paid off in 17 years and 3 months. End balance, Interest, Principal, End balance. 1. For example, if you borrow $, at a 4% interest rate, your very first monthly payment will include $ in interest and $ toward the principle. Use this calculator to input the details of your mortgage and see how those payments break down over your loan term. Find out how much your monthly mortgage payment could be, based on your home's purchase price and the terms of your loan. Calculate the true cost of homeownership and the impact of monthly allocations with the Total Mortgage Costs Calculator from E-Central Credit Union in CA. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. How Do I Lower My Monthly Mortgage Payment? · Don't pay for PMI: A down payment of at least 20% will mean not having to pay for private mortgage insurance each. Simple. Multiply the monthly payment by That's the total of your payments (if that's the question). Subtract the original loan principal. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. By paying extra $ per month starting now, the loan will be paid off in 17 years and 3 months. End balance, Interest, Principal, End balance. 1. For example, if you borrow $, at a 4% interest rate, your very first monthly payment will include $ in interest and $ toward the principle.

Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. How to use the calculator To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes. How Does Mortgage Interest Work? Mortgage interest is the interest you pay on your home loan. It is based on the interest rate agreed to at the time you sign. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Most experts recommend that your monthly mortgage payment should not exceed 35% of your gross income. But that is the upper end. Other models are more. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. To find out how you. of equity you have in your home. Our calculator limits your interest deduction to the interest payment that would be paid on a $1,, mortgage. Interest. Use a mortgage calculator to see how various loan terms impact your monthly payment, the amount of interest you'll pay, and the total cost of the home. Remember. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. How much interest will I pay on my mortgage? The exact amount of interest you'll pay depends on the mortgage rate you're on. This can change over time. For. Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. A year fixed-rate mortgage has a higher. How? By making payments every two weeks you actually end up paying more per year (the equivalent of one extra monthly payment). Bi-Weekly Mortgage Calculator: How much interest will I save paying my mortgage biweekly instead of monthly? will I owe (balloon) at the end of the payment. of interest you will pay regarding your home loan mortgage insurance can end up impacting your monthly payment amount. Budget. Mortgage payments are made up of your principal and interest payments. · If you make a down payment of less than 20%, you will be required to take out private.

1 2 3 4 5 6