traineforranking.ru Gainers & Losers

Gainers & Losers

Jp Morgan Emerging Markets Equity Fund R6

These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging. Get EMRSX mutual fund information for JPMorgan-Emerging-Markets-Research-Enhanced-Equity-Fund-Class-R6, including a fund overview,, Morningstar summary. The Fund seeks to provide high total return. The Fund invests at least 80% of the value of its assets in equity securities and equity-related instruments that. Get the Latest Earnings Report of JPMorgan Emerging Markets Equity Fund Class R6. Check out JEMWX Estimated and Actual Earnings. Get the latest JPMorgan International Equity Fund Class R6 (JNEMX) real-time quote, historical performance, charts, and other financial information to help. JPMorgan Emerging Markets Equity Fund JEMWX has $ MILLION invested in fossil fuels, % of the fund. The fund invests at least 80% of the value of its assets in equity securities and equity-related instruments that are tied economically to emerging markets. JPMorgan Emerging Markets Equity Fund R6 (JEMWX) - Price and Analysis - mutual fund quote, history, news, and other vital information to help you with your. Designed to deliver total return primarily from a portfolio of emerging market debt instruments. · Invests primarily in sovereign debt securities from emerging. These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging. Get EMRSX mutual fund information for JPMorgan-Emerging-Markets-Research-Enhanced-Equity-Fund-Class-R6, including a fund overview,, Morningstar summary. The Fund seeks to provide high total return. The Fund invests at least 80% of the value of its assets in equity securities and equity-related instruments that. Get the Latest Earnings Report of JPMorgan Emerging Markets Equity Fund Class R6. Check out JEMWX Estimated and Actual Earnings. Get the latest JPMorgan International Equity Fund Class R6 (JNEMX) real-time quote, historical performance, charts, and other financial information to help. JPMorgan Emerging Markets Equity Fund JEMWX has $ MILLION invested in fossil fuels, % of the fund. The fund invests at least 80% of the value of its assets in equity securities and equity-related instruments that are tied economically to emerging markets. JPMorgan Emerging Markets Equity Fund R6 (JEMWX) - Price and Analysis - mutual fund quote, history, news, and other vital information to help you with your. Designed to deliver total return primarily from a portfolio of emerging market debt instruments. · Invests primarily in sovereign debt securities from emerging.

Complete JPMorgan Emerging Markets Equity Fund;R6 funds overview by Barron's. View the JEMWX funds market news. The Fund is a closed-end exchange traded management investment company. This material is presented only to provide information and is not intended for trading. Jpmorgan Emerging Markets Equity Fund R6: (MF: JEMWX). (NASDAQ Mutual Funds) As of Jul 19, PM ET. Add to portfolio. $ USD. (%). JPMorgan Emerging Markets Equity Fund. Payout Change. Pending. Price as of: AUG R6. Currency. USD. Domiciled Country. US. Manager. Austin Forey. Fund. Designed to provide long-term capital appreciation. · Invests in companies from emerging markets around the world · Seeks to outperform the MSCI Emerging Markets. JPMORGAN EMERGING MARKETS RESEARCH ENHANCED EQUITY FUND CLASS R6- Performance charts including intraday, historical charts and prices and keydata. The investment seeks to provide long-term capital appreciation. Normally, the fund invests at least 80% of its assets in equity securities and. The fund invests at least 80% of the value of its assets in equity securities and equity-related instruments that are tied economically to emerging markets. Get the latest JPMorgan Emerging Markets Equity Fund Class R6 (JEMWX) stock price quote with financials, statistics, dividends, charts and more. Get JPMorgan Emerging Markets Equity Fund Class R6 (JEMWX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The investment seeks to provide high total return. The fund invests at least 80% of the value of its assets in equity securities and equity-related. The fund has assets totaling almost $ billion invested in 75 different holdings. Its portfolio consists of at least 80 percent emerging market stocks at. The investment seeks to provide high total return. The fund invests at least 80% of the value of its assets in equity securities and equity-related instruments. JEMWX: JPMorgan Emerging Markets Equity Fund R6 - Fund Performance Chart. Get the lastest Fund Performance for JPMorgan Emerging Markets Equity Fund R6 from. Find our live Jpmorgan Emerging Markets Equity Fund Class R6 fund basic information. View & analyze the JEMWX fund chart by total assets, risk rating. JPMorgan Emerging Markets Equity Fund71, Investing solely in JPMorgan Emerging Markets Equity Fund (Class R6) Managed by J.P. Morgan Investment Management. Get a technical analysis of JPMorgan Emerging Markets Equity Fund R6 (JEMWX) with the latest MACD of and RSI of Stay up-to-date on market trends. The investment seeks to provide high total return. The fund invests at least 80% of the value of its assets in equity securities and equity-related. Check out JPMorgan Emerging Markets Equity R6 via our interactive chart to view the latest changes in value and identify key financial events to make the. JPMorgan Emerging Markets Equity Fund;R6 advanced mutual fund charts by MarketWatch. View JEMWX mutual fund data and compare to other funds.

Capital Gain On Selling Property

In general, half (50%) of the capital gain realized on the disposition (sale, transfer, exchange, gift, etc.) of a property is taxable. Some of the differences include, but are not limited to: sales of business assets; IRC Section (h)(10) transactions; like-kind exchanges; wash sales; capital. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. Capital gains rates are subject to change depending on Congressional action. Federal taxes on your net capital gain(s) may vary depending on your marginal. Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a %. A capital gain is the profit you make from selling or trading a "capital asset." With certain exceptions, a capital asset is generally any property you hold. Capital gains taxes are levied on earnings made from the sale of assets like stocks or real estate. Based on the holding term and the taxpayer's income level. It's important to note that capital gains only apply if the property has been sold for more than its original purchase price – any profit made on the sale of a. If you sell your home, you may exclude up to $ of your capital gain from tax ($ for married couples), but you should learn the fine print first. In general, half (50%) of the capital gain realized on the disposition (sale, transfer, exchange, gift, etc.) of a property is taxable. Some of the differences include, but are not limited to: sales of business assets; IRC Section (h)(10) transactions; like-kind exchanges; wash sales; capital. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. Capital gains rates are subject to change depending on Congressional action. Federal taxes on your net capital gain(s) may vary depending on your marginal. Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a %. A capital gain is the profit you make from selling or trading a "capital asset." With certain exceptions, a capital asset is generally any property you hold. Capital gains taxes are levied on earnings made from the sale of assets like stocks or real estate. Based on the holding term and the taxpayer's income level. It's important to note that capital gains only apply if the property has been sold for more than its original purchase price – any profit made on the sale of a. If you sell your home, you may exclude up to $ of your capital gain from tax ($ for married couples), but you should learn the fine print first.

In this article, we'll explain how taxes on capital gains work, and how to avoid paying capital gains tax on rental property. When you sell a rental property, you may have to pay capital gains taxes and recaptured depreciation taxes, technically called unrecaptured section gain. When you sell a stock, you owe taxes on the difference between what you paid for the stock and how much you got for the sale. The same holds true in home. You can sell your primary residence and be exempt from capital gains taxes on the first $, if you are single and $, if married filing jointly. This. Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. When you sell a rental property, you may have to pay capital gains taxes and recaptured depreciation taxes, technically called unrecaptured section gain. You will be required to report basic information (date of acquisition, proceeds of disposition and description of the property) on your income tax and benefit. Unlike regular income tax, capital gains tax is applied to the income that you earn as a result of the sale of a tangible asset like a stock or real estate. No, there are many times when selling an asset does not result in a taxable gain. Capital gains taxes generally only apply to assets held in a taxable account. If you meet the ownership and use tests, the sale of your home qualifies for exclusion of $, gain ($, if married filing a joint return). This. So, the CRA allows you to delay paying the tax until you actually sell the property – this is called a “deferred election”. Just keep in mind that if you choose. For example, a property acquired for $, with a selling price of $, has a capital gain of $, Previously only 50% of capital gains would have. A capital gain is the amount you get from selling property, like stock, a house, or a mutual fund. For example, if you buy stock for $1, and sell it for. Under FIRPTA, foreign nationals selling U.S. real estate are subject to tax on any capital gain. The IRS requires a 15% withholding of the sale price as a. Usually you don't have to pay tax on any capital gains from the sale of your home if the property was your principal residence for every year you owned it . A special real estate exemption for capital gains. Since , up to $, in capital gains ($, for a married couple) on the sale of a home is exempt. The net capital gain from selling collectibles (such as coins or art) is subject to a The part of any net capital gain on property for which the taxpayer. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. If you meet the conditions for a capital gains tax exemption, you can exclude up to $, of gain on the sale of your main home. Certain joint returns.

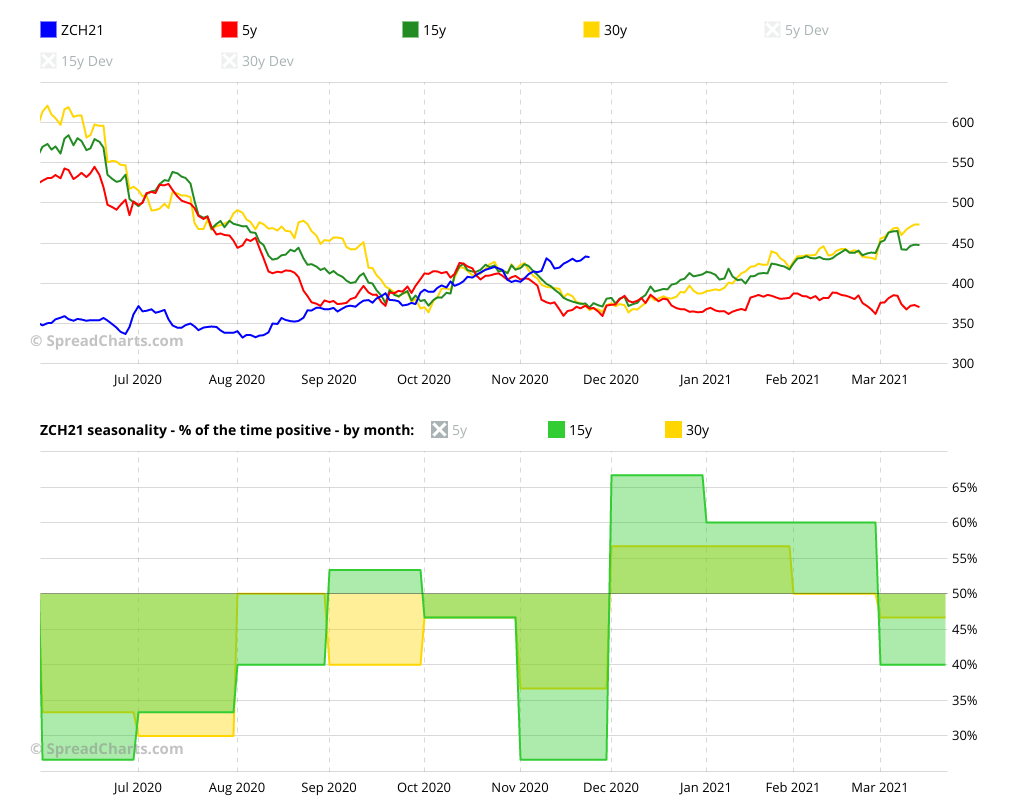

Corn Futures Market Analysis

All of the latest analysis and reports about US Corn Futures. The largest futures market for corn is at the CME Group. Corn futures also trade at the B3 exchange, the Dalian Commodity Exchange, the Euronext Derivatives. Corn futures closed out the Thursday session with contracts steady to down 2 cents across the front months. The front month cmdtyView US cash corn price. Corn prices averaged USD cents per bushel in July, down % from June. On 31 July, the commodity traded at USD cents per bushel, down % from In sum, trading corn futures can offer a compelling mix of risk management, speculative opportunities, portfolio diversification, and market liquidity, making. Corn futures trading is the act of buying or selling an exchange traded corn futures contract for expiration or delivery on a predetermined date for a. This US Corn Futures technical analysis page contains a brief summary for US Corn Futures: either strong Buy, Buy, Strong Sell, Sell or Neutral signals. The high price for this year's May corn was $ and ¾ cents per bushel. Low refers to the lowest price at which a commodity futures contract traded during the. The /25 season's first survey-based corn yield forecast is bushels per acre higher than last month's projection at bushels per acre. However, a All of the latest analysis and reports about US Corn Futures. The largest futures market for corn is at the CME Group. Corn futures also trade at the B3 exchange, the Dalian Commodity Exchange, the Euronext Derivatives. Corn futures closed out the Thursday session with contracts steady to down 2 cents across the front months. The front month cmdtyView US cash corn price. Corn prices averaged USD cents per bushel in July, down % from June. On 31 July, the commodity traded at USD cents per bushel, down % from In sum, trading corn futures can offer a compelling mix of risk management, speculative opportunities, portfolio diversification, and market liquidity, making. Corn futures trading is the act of buying or selling an exchange traded corn futures contract for expiration or delivery on a predetermined date for a. This US Corn Futures technical analysis page contains a brief summary for US Corn Futures: either strong Buy, Buy, Strong Sell, Sell or Neutral signals. The high price for this year's May corn was $ and ¾ cents per bushel. Low refers to the lowest price at which a commodity futures contract traded during the. The /25 season's first survey-based corn yield forecast is bushels per acre higher than last month's projection at bushels per acre. However, a

Corn futures are the most liquid and active market in grains, with , contracts traded per day.

Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Traders use it to see if the asset is oversold or overbought. We've counted how many oscillators show the neutral, sell, and buy trends for Corn Futures — the. Hoffman,. Market and Trade Economics Division, Economic Research Service, U.S.. Department of Agriculture. Technical Bulletin No. Abstract. Annual models. It includes a review of the commodity futures market and the ways it influences the price you receive for your grain. It explains how and when to use pricing. July futures contract was down by 2 cents per bushel to $ per bushel, while September futures declined by 5 cents to $ per bushel. Commodity futures prices and option prices for agricultural commodities at key exchanges. Find corn, soybean, wheat, cotton, oats, cattle, pork, and dairy. Corn futures plummeted to approximately $, reaching their lowest level in nearly four years due to a robust production outlook, supported by favorable. Corn prices averaged USD cents per bushel in July, down % from June. On 31 July, the commodity traded at USD cents per bushel, down % from The largest futures market for corn is at the CME Group. Corn futures also trade at the B3 exchange, the Dalian Commodity Exchange, the Euronext Derivatives. Use the chart below to check futures prices for corn. Click the contract dates for more prices and trends. Cash price reflects the USDA Chicago terminal. Corn futures are one of the most commonly traded agricultural futures and corn futures contracts are the most active in the oils and seeds futures market. At a Glance · Corn prices shift 3 to 4 cents higher, while soybeans find gains of around 9 cents. · Most wheat contracts grab double-digit gains on Wednesday. Analyze your stocks, your way. Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. Subscribe Now ->. C00 | A complete Corn Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures trading. Trading corn futures attracts many traders who are interested in the grain market. Corn futures practically do not differ from other grain futures. Today its technical rating is neutral, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Corn. The purpose of the B3 Corn Futures Index is to be the indicator of the total return of a theoretical portfolio composed of the Corn futures contract (CCM). Use the chart below to check futures prices for commodities. Click the links for pricing on grains, livestock, oil and more and stay on top of what's going on. Summary · News · Chart · Historical Data · Futures. CBOT - Delayed Quote • USX. Corn Futures,Dec (ZC=F). Follow. (%). As of PM EDT.

2 3 4 5 6